Account Abstraction at the Protocol Level

What is account abstraction? permalink

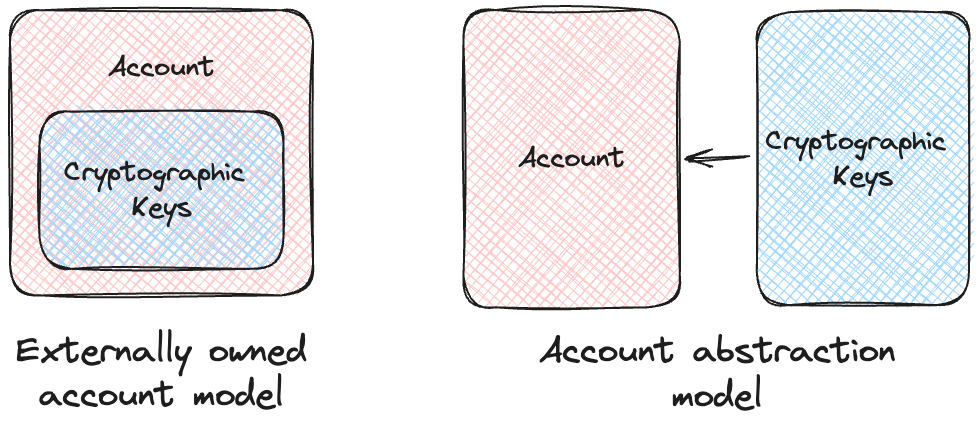

In a nutshell, account abstraction is the ability to separate cryptographic keys from an account.

In Ethereum, the account model is such that accounts operated by users (Externally Owned Account, or EOA) start off as a private key (ECDSA secp256k1), which is used to generate a public key, and this in turn is used to generate an address. The account is thus inseparable from its private key, public key, and address. Almost all other EVM-compatible networks have followed Ethereum, and EOAs work the same way across multiple networks.

While the EOA approach has worked well for its intended use cases, new and interesting use cases are made possible when cryptographic keys are separated from their accounts. Account Abstraction uses an alternative account model where this is possible.

What is protocol-level account abstraction? permalink

Let’s say that the account model does not need to work in the way that EOAs do in Ethereum, and we could start afresh… In other words, design a new account model. What would that look like? What traits/ behaviours should accounts ideally have in order to enable account abstraction?

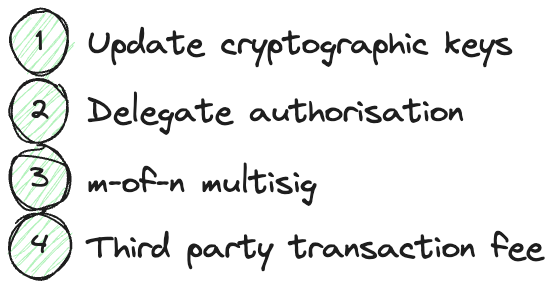

Here are four necessary properties:

- (1) An account should be able to update its own cryptographic keys.

- (2) An account should be able to delegate the ability to operate on its behalf

- to another account, and/or

- to a smart contract.

- (3) An account should enable m-of-n multisig, where authorisation can be provided

- by a cryptographic key signature, and/or

- by invocation of a specified smart contract.

- (4) Authorising (signing) a transaction and paying for a transaction should be performed

- by the same account in both cases, or

- by different accounts

If accounts in a network can exhibit all four of the above properties, that would mean that this network supports account abstraction at a protocol level.

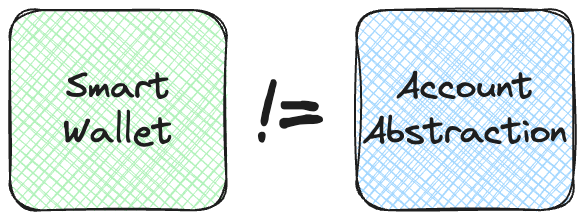

Does account abstraction equal smart wallets? permalink

In short: No.

Smart wallets are wallets that are controlled through smart contracts, in a non-custodial manner. They can be implemented using account abstraction, or through other means. Account abstraction can be thought of as a lower-level concept — where smarts wallets are the application and account abstraction is the underlying protocol.

Stated in another way: When the term “smart wallets” is used interchangeably with “account abstraction,” an application built using a protocol is being conflated with the protocol. This would incorrectly imply that the protocol has a single purpose.

What does account abstraction achieve? permalink

Those who are new to web3 are likely to find DApps (Web3 applications) too difficult to use. Interacting with DApps requires users to be far more tech-savvy than they were with web2 applications.

One of the first steps in using any application is to create an account, then log in to your account. Unfortunately most DApp users often get tripped up during these initial steps, due to the much higher technical complexity compared to doing the equivalent initial steps in a web2 application. There have been many attempts to solve this in various web3 applications, but so far none of them have gotten close to the simplicity of the humble username-password combination, plus the ability to reset passwords when you forget them.

Some web3 applications have a “solution” for this: Let users continue using usernames and passwords, amounting to a faux account.

In this case, the web3 application will manage the account (cryptographic keys included) on its own web2 server, which has custody of the real account. While this approach technically works, it misses the whole point of web3 technology and philosophy. In this scenario, users may as well use a web2 application instead.

Remember: Not your keys, not your crypto.

(It is presently 2023, a whole 14 years since Bitcoin’s inception… yet the above still needs to be said.)

So how can you solve this problem? Is a true equivalent to the user experience of accounts on web2 possible on web3? One that does not involve ceding custody of keys to any (centralised) entity?

Account abstraction, as it turns out, is a great way to achieve that! One of the use cases for account abstraction is the ability to recover your account in a decentralised manner, as illustrated in these articles:

Recovering accounts in this manner solves the first (and major) hurdle to the adoption of web3 technology. What else can account abstraction enable?

- Easy to understand transactions: Transferring currency (fungible tokens) without the need to manage a separate currency (native coin) for transaction fees.

- Cheaper transactions: Transferring currency (fungible tokens) with transaction fees subsidised or discounted.

- Cheaper transactions (again): Lower average network transaction fees, by bundling operations of multiple users into a single transaction.

- Programmability/ flexibility: Generally, any task that can be performed by a smart contract.

Can account abstraction accelerate the adoption of web3 tech? permalink

In short: Yes.

A network with account abstraction enables developers to create web3 applications that can be understood more easily by users who have more experience with web2 applications. Without account abstraction, the upper limit for the number of users of web3 applications is bound by the number of users with technical savvy. With account abstraction, on the other hand, it follows that this limit will be removed, thereby increasing web3 adoption rates.

This could kick off a positive feedback loop, where this incentivises more companies that currently build web2 applications to start building web3 applications as well. Perhaps it might even inspire more web2 companies to switch to a web3-first approach, and build web3 applications instead of web2 applications.

Web2 companies typically choose to adopt web3 technology for a couple of reasons:

- The buzzword factor.

- The desire for web3 traits:

- The ability to create immutable and transparent public records in a decentralized manner.

- The ability to remove trust assumptions. For example, no need to trust the entity hosting the databases or web servers.

The buzzword-inspired companies are usually motivated by generating press attention at worst, and innovation pilots/ proofs-of-concept at best. Let’s set these aside.

Instead, let’s focus only on web2 companies who have truly understood and internalised the value of web3 principles and want to bring them in-house. These companies would be willing to build their products based on those fundamentals; however, they will not be willing to do so at all if they cannot turn a profit by doing so. If these companies think that web3 technology adoption will place an upper limit on user acquisition, they simply will not make the jump.

Without account abstraction, web3 does indeed have this problem — an adoption barrier. By lowering the barrier to enjoy and adopt web3, those same companies that are currently holding back on building their products with web3 technology, may now reconsider and decide to go through with it. This will be critical to adoption!

However, this comes with a big caveat. Whenever there is any new technology introduced, you can be sure of two things: (1) It will be used to build more or better software, perhaps in ways that weren’t possible before; and (2) The attackable surface area will increase, and this will inevitably lead to exploits as security vulnerabilities are discovered.

When the latter happens, new sets of security best practices would need to be created and implemented to counter them. The good news is that unlike when the EVM (and smart contracts in general) first started, there are now far more players with expertise in web3 technologies in the security space compared to back then. They are far more established too. It is likely that the feedback cycles will be shorter as a result, and we will see a quicker turnaround from attack vector discovery through to adoption of security best practices that counter each new vector.

Is there a concrete example of protocol-level account abstraction in action? permalink

On Ethereum, the preferred approach toward implementing account abstraction is EIP-4337. Its abstract reads as follows:

“An account abstraction proposal which completely avoids the need for consensus-layer protocol changes. Instead of adding new protocol features and changing the bottom-layer transaction type, this proposal instead introduces a higher-layer pseudo-transaction object called a

UserOperation. Users sendUserOperationobjects into a separate mempool. A special class of actor called bundlers package up a set of these objects into a transaction making ahandleOpscall to a special contract, and that transaction then gets included in a block.”

Essentially, Ethereum’s accounts and transaction model, at the protocol level, does not support account abstraction, and therefore, UserOperation and special contracts are needed.

Hypothetically, this would not be needed if the protocol supports the four properties in its account model, as outlined in the “What is protocol-level account abstraction?” section earlier.

- (1) An account should be able to update its own cryptographic keys.

- (2) An account should be able to delegate the ability to operate on its behalf

- to another account, and/or

- to a smart contract.

- (3) An account should enable m-of-n multisig, where authorisation can be provided

- by a cryptographic key signature, and/or

- by invocation of a specified smart contract.

- (4) Authorising (signing) a transaction and paying for a transaction should be performed

- by the same account in both cases, or

- by different accounts

Let’s contrast Ethereum’s account abstraction approach with what is available on Hedera.

Hedera simultaneously:

- Is EVM-compatible, and

- does not follow Ethereum’s account model.

This article will not detail exactly how this is possible or how it works. Instead, please refer to my presentation: Understanding Hedera through EVM-related HIPs (press S to view detailed notes on each slide).

tl;dr= Hedera launched with its own account model (in 2019), and subsequently added EVM equivalence (in 2022). This included:

- Adding support for ECDSA secp256k1 keys, in addition to EdDSA ED25519 keys.

- Adding an

EthereumTransactiontransaction type which would “wrap” EVM-compatible transactions within the existing transaction model - Creating an “account alias” system that would map conversions between “native accounts” and EVM addresses.

Hedera has its own accounts and transactions protocol, which exhibits all four of the properties listed earlier.

Again, this article does not intend to detail how this is possible or how it works. Instead, please refer to another presentation: Account Abstraction on EVM-compatible networks: Hedera and Ethereum (press S to view detailed notes on each slide).

tl;dr= Check out the following two code demos that illustrate how to perform protocol-level transactions on an account to transfer fungible tokens, which is one of the key uses cases for smart wallets:

multisig-account: How to use native m-of-n multisig with cryptographic keys to authorise transactions.multisig-sc-account: How to use native m-of-n multisig with a mix of cryptographic keys and smart contracts to authorise transactions.

In effect, the primary difference is that the native account and transaction models on Hedera are designed to allow accounts to be separate from their cryptographic keys. This breaks the fundamental limitation of the Externally Owned Account (EOA) concept from Ethereum, which is that 1-to-1 mapping from cryptographic keys to accounts.

The implication of this is that almost all of the required ingredients for account abstraction are already present in Hedera.

This poses an interesting challenge for Hedera. While the network has been around much longer, EVM-compatibility has been in place for only around 2 years now - as opposed to since inception (by definition) for Ethereum. And this has a knock-on effect. In this case, when implementing account abstraction, should Hedera follow the path trodden by Ethereum (such as EIP-4337)? Or should Hedera tread its own path that leverages its fundamentally different account model?

Thanks to Joshia Seam, Ying Tong, Emerson Liang, Ed Marquez, Nana Essilfie-Conduah, Danno Ferrin, and Doug von Kohorn for reviewing this post.

This article has been republished on the Hedera blog: https://hedera.com/blog/account-abstraction-at-the-protocol-level